income tax plus capital gains tax

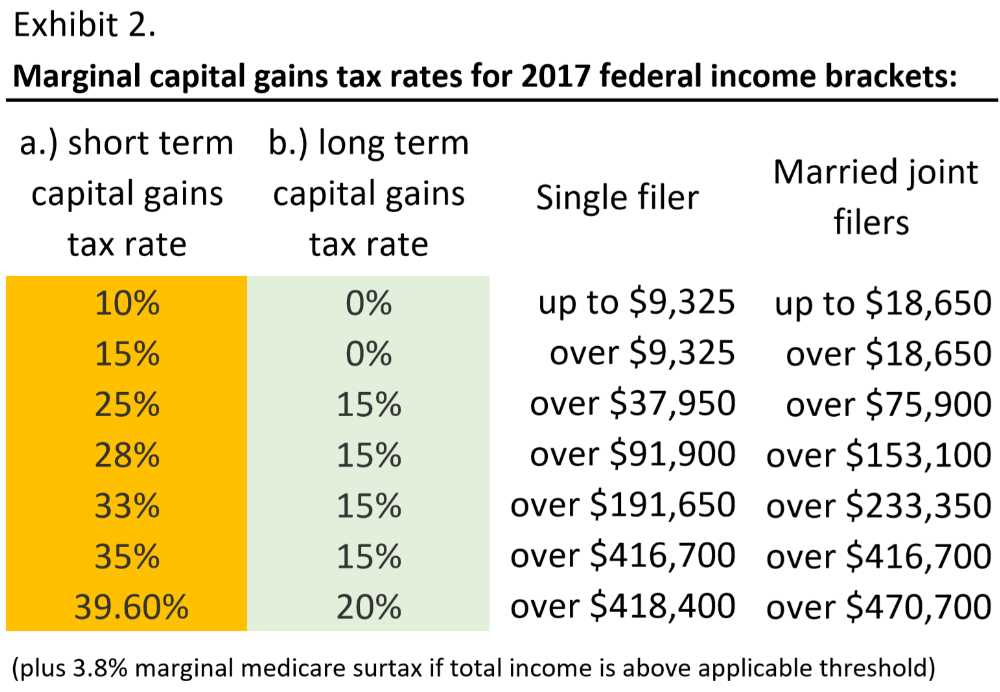

Again short-term capital gains are taxed using the same rates as ordinary income taxes which are much higher than the rates above. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

State Taxes On Capital Gains Center On Budget And Policy Priorities

If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

. Most investors pay capital gains taxes at lower tax rates than they would for ordinary income. Tax as short-term capital gain. This can lower your taxable income range.

How the 0 Rate Works. Short-term gains are taxed as ordinary income based. However since there was inflation during this period the.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. The property tax credit is equal to 5 of the Illinois property tax paid on your primary residence. Reason for bifurcation of capital gains into long-term and short-term gains The taxability of capital gains depends on the nature of gain ie whether short.

For example if you earned 1000000. Governor Inslee signed the bill. A new client is an individual who did not use HR Block office services to.

2022 2023 Capital Gains Tax. The tax applies to high earners who receive capital gains income. 27300 25900 plus an additional 1400 for a filer over 65 theyre left with 72700 in taxable.

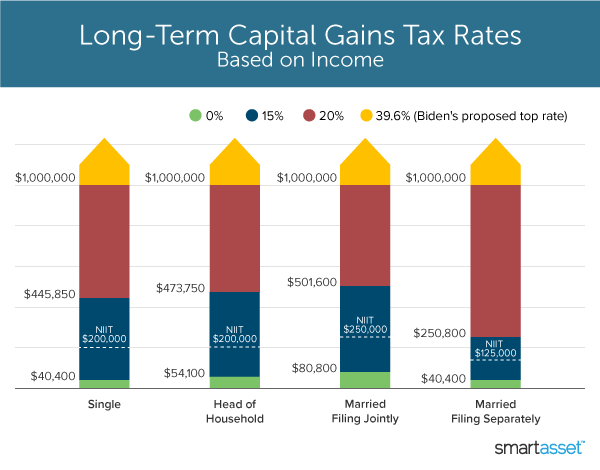

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. Most investors pay capital gains taxes at lower tax rates than they would for ordinary income. As a result he realized a capital gain of 9249 and must pay the 238 percent tax 16 of 2201 on this nominal gain.

Heres how to calculate your taxable income to harvest tax-free gains. In 2021 and 2022 the capital gains tax rate is 0 15. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains.

When your other taxable income after deductions plus your qualified. This reduction is also calculated on your taxes and is calculated into your capital gains taxes. For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is.

Capital Gain Tax Rates. So short-term capital gains are added to. Dont be afraid of going into the next tax bracket.

The tax rate on most net capital gain is no higher than 15 for most individuals. In April 2021 the Washington legislature voted to impose a state income tax. If you decide to sell youd now have 14 in realized capital gains.

Progressive Tax Rates. 2022 capital gains tax rates. In tax year 2021 the 0 tax rate on capital gains applies to married taxpayers who file joint returns with taxable incomes up to 80800 and to single.

Based on filing status and taxable income long-term capital gains for tax year 2022 will be taxed at 0 15 and 20. 2021-2022 Capital Gains Tax Rates Calculator 1 week ago Feb 24 2018 2021 capital gains tax calculator. Income tax plus capital gains tax Saturday October 15 2022 Edit.

Weve got all the 2021 and 2022 capital gains. Some or all net capital gain may be taxed at 0 if your taxable income is.

2022 Income Tax Brackets And The New Ideal Income

T03 0030 Administration S Dividend Proposal Plus Tax Capital Gains At Ordinary Rates Distribution Of Income Tax Change By Percentiles 2003 Tax Policy Center

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2022 2023 Tax Brackets Standard Deduction 0 Capital Gains Etc

Biden Eyeing Tax Rate As High As 43 4 In Next Economic Package Bloomberg

Real Estate Tax Benefits The Ultimate Guide

What S In Biden S Capital Gains Tax Plan Smartasset

The Tax Impact Of The Long Term Capital Gains Bump Zone

2022 Income Tax Brackets And The New Ideal Income

Mechanics Of The 0 Long Term Capital Gains Rate

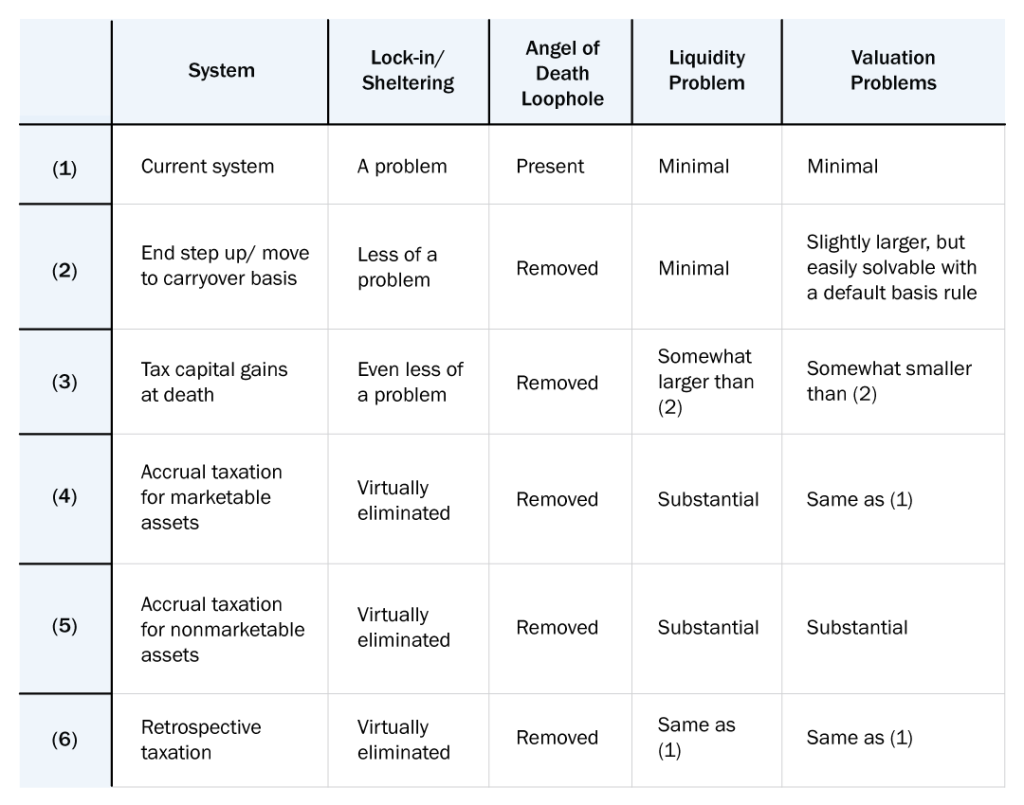

What Are Capital Gains Taxes And How Could They Be Reformed

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It

How To Know If You Have To Pay Capital Gains Tax Experian

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

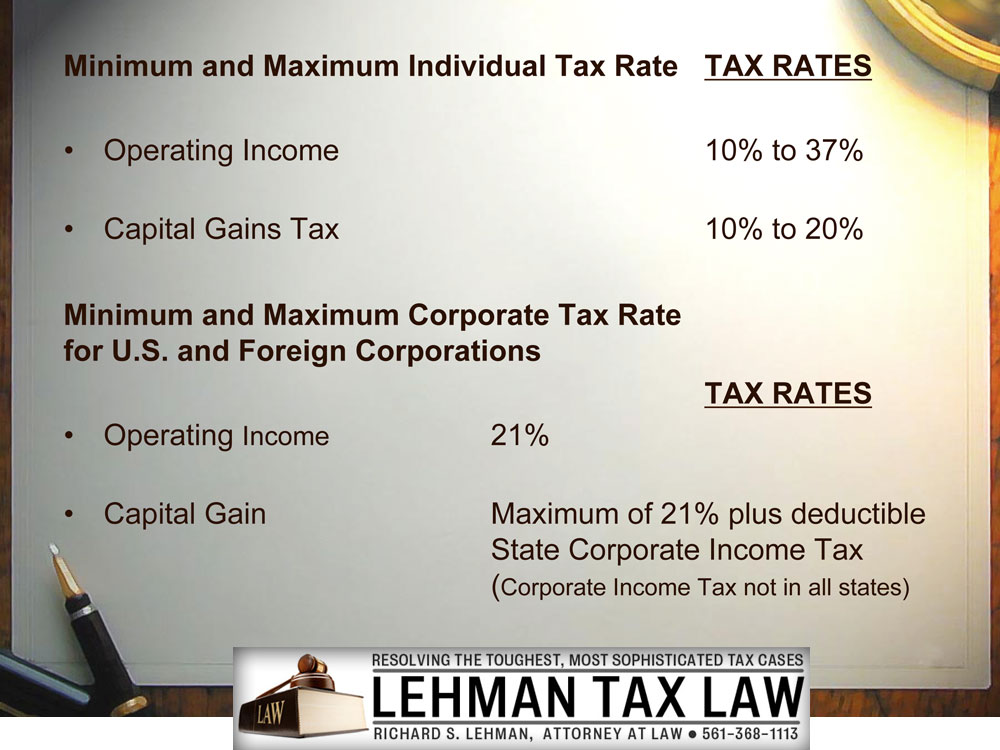

U S Capital Gains Tax For Foreign Investors United States Taxation Of Foreign Investors With Richard S Lehman Tax Attorney